Moreturn, Inc.

- 83, Uisadang-daero, Yeongdeungpo-gu, Seoul, Republic of Korea

- 010-9588-3267

- help@moreturn.co.kr

[Key Technology]

"Automating repetitive tasks in loan management (such as interest calculation, notifications, and certificate issuance etc.) and monitoring changes in collateral.

Reassessing collateral prices and reclassifying asset quality by collecting information in real-time.

Using AI to appraise real estate, such as small plots of land and single-family homes that large institutions cannot evaluate, and estimating the likelihood of mortgage loan recovery."

[Company Profile]

"Moreturn, Inc. believes that non-financial institutions expanding into lending business can include more financially underserved individuals.

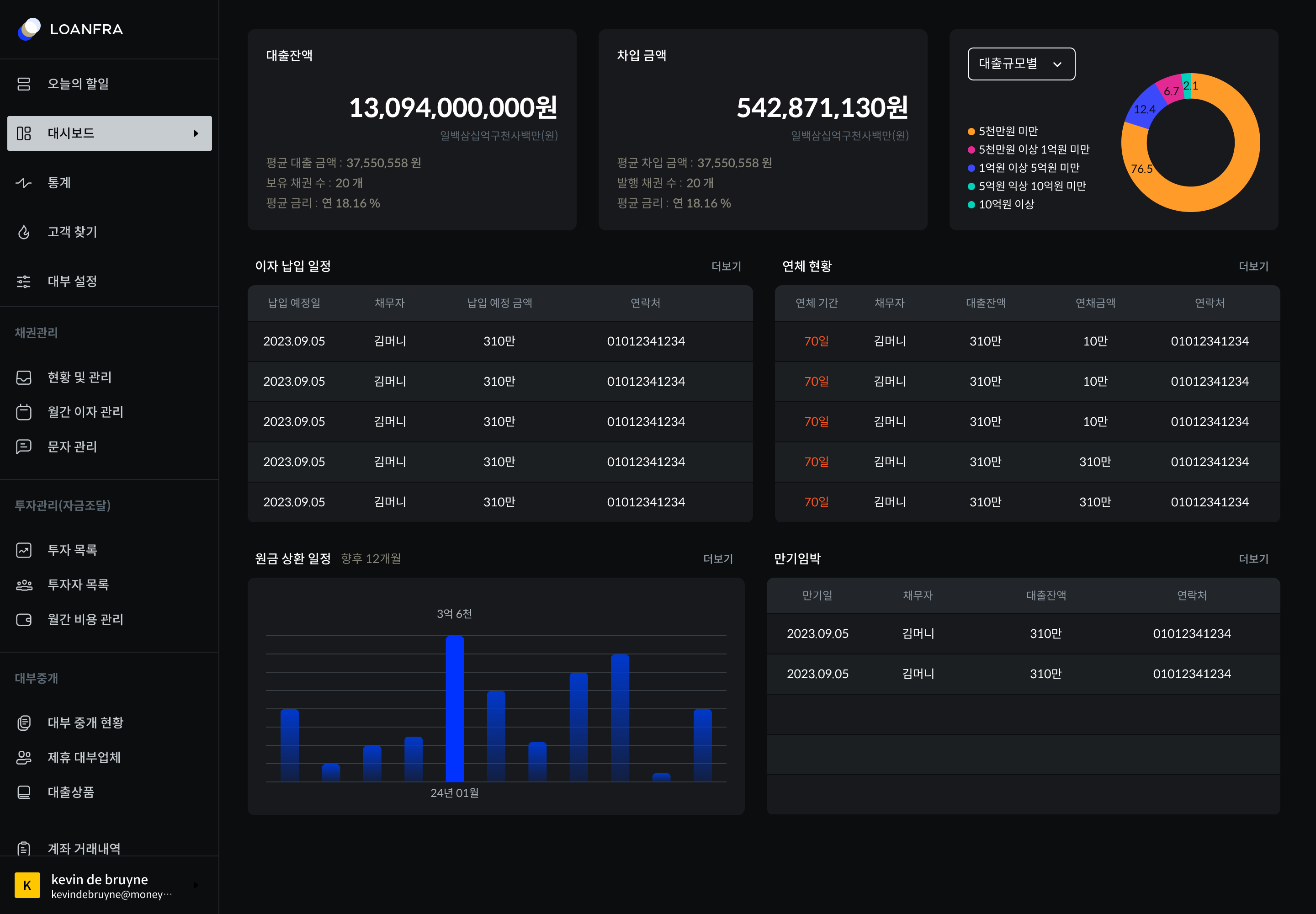

Through the AI agent LOANFRA, non-financial institutions can easily engage in credit finance.

80 clients are using LOANFRA to manage surplus cash. The investment period is less than one year, with an annual interest rate of 10%, and it is secured by high-quality housing with an average 65% LTV."

[Key Products]

"AI agent LOANFRA is an affordable digital financial infrastructure designed for SME financial institutions. LOANFRA automates loan management tasks to reduce operating costs and simplifies communication with loan brokers to accelerate the lending process.

SME institutions provide loans to those who are financially excluded by large institutions, and LOANFRA collects this data to develop AI-powered credit scoring model capable of assessing the largest number of borrowers."